2012/07/30

by Robert Morris

Robotic manufacturing is not capital intensive, contrary to the popular wisdom. (Looking at you HBS.)

Unless someone can bring data to the contrary, we should treat this issue as thoroughly decided against the conventional wisdom. As we saw previously, robotics companies do not need a lot of fixed assets. Now, we will see why people who blithely repeat the conventional wisdom that robotics companies are capital intensive are wrong–even if they claim robotics companies are hiding their true use of capital.

First off, robotics companies’ balance sheets look like technology companies’–the internet kind, not the aerospace/industrial kind. Robotics companies have lots of cash and relatively little else.

Second, robotics companies have gross margins that even companies that don’t make stuff would envy. The robotics gross margin would probably be even higher if iRobot and Aerovironment were not defense contractors. There is a lot of pressure to bury as much expense as allowed into the cost of goods due to defense contract rules. Intuitive and Cognex’s margins are around 75%. They are even beating Google on gross margin!

Although, it does appear that robotics companies have a bit longer cash conversion cycle than the basket chosen for comparison here, their cash cycle appears to be in line with other complex manufacturers. Plus, the robotics companies are holding so much cash their management may just not really care to push the conversion cycle down.

Look at the cash required to sell aircraft though! Manned or unmanned it looks like it takes forever to get paid for making planes.

Although robotics companies have physical products, the value of a robot is in the knowledge and information used to create it and operate it. The materials are nothing special. Consequently, these companies look like part of the knowledge economy–few real assets, lots of cash, and huge attention to their workforce. Next time someone tells you robotics companies are capital intensive, ask them to share what they’re smoking–it’s probably the good stuff–because they aren’t using data.

One thing that a venture capitalist may mean when he says that robotics is capital intensive is that it generally takes a long time and lots of money to develop a viable product in robotics. This may be true, but it is not really the same thing as being capital intensive. This observation should cause a lot of soul-searching within our industry. What the venture capitalist is telling us is that we–as an industry–cannot reliably manage our engineering, product development, and business structures to produce financial results.

This is why the conventional wisdom is dangerous. It suggests that the lack of investors, money, and talent flowing into our industry isn’t our fault and there’s not much we can do about it. That is what needs to change in robotics. We need to get better at management. We need to start building companies quicker and producing returns for our investors. If we do that the money, talent, and creativity will start pouring into industry. Then robotics can change the world.

Notes on Data and Method

Data Source: Last 10-k

Method:

Accounts Receivable = All balance sheet accounts that seem to be related to a past sale and future cash, so accounts receivable plus things like LinkedIn’s deferred commissions.

Cash + Investments = All balance sheets I could identify as being financial investments not required to operate. Assume all companies require zero cash to operate.

Did not account for advances in cash conversion cycle.

East Coast Chauvinism in Robotics: Time to Face Facts, Silicon Valley is Kicking Our Ass

2012/06/24 by Robert Morris Leave a comment

A cleaned-up version of this article became my first post on Hizook. http://www.hizook.com/blog/2012/06/25/east-coast-chauvinism-robotics-time-face-facts-silicon-valley-kicking-our-butt#comment-971

_______

I have lots of love for Pittsburgh in particular, but it really pisses me off when people on the East Coast repeat a bunch of falsehoods (See #8) about how Boston and Pittsburgh compare to Silicon Valley and the rest of the world. Many people in Pittsburgh and Boston—including people I call friends and mentors—smugly think that the MIT and CMU centered robotics clusters are leading the world in robotics. This is demonstrably false.

If leadership in robotics means forming companies, making money, or employing people, then Silicon Valley is crushing everyone—no matter what the Wall Street Journal editorial page says about their business climate. I’ve previously published an analysis of the Hizook 2011 VC Funding in Robotics data that shows that the Valley gets 49% of total VC robotics investment worldwide.

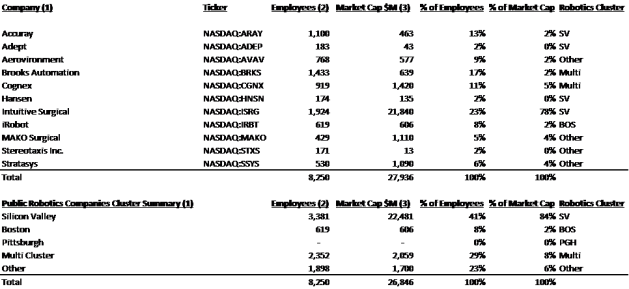

I’d now like to add an analysis of U.S. public companies (see bottom of the page). Basically, the ‘Pittsburgh and Boston are the center of the robotics world’ story is even more ridiculous if you look at where public robotics companies are located. Silicon Valley is crushing the other clusters in the U.S. at creating value in robotics and in building a robotics workforce in public companies. (A forthcoming analysis will show that this true worldwide and if you include robotics divisions of public companies not principally engaged in robotics such as Boeing and Textron.)

77% of the workforce at public robotics pure plays is in Silicon Valley companies. An astounding 93% of the market capitalization is headquartered in Silicon Valley and even if you exclude Intuitive Surgical (NASDAQ:ISRG) as an outlier, the Silicon Valley cluster still has twice as much market capitalization as Boston.

The public companies that I deemed to meet the criteria of being principally engaged in robotics, that they had to make and sell a robot, and not have substantial value creating revenues from businesses not related to robotics are listed in the table below.

The one company that I believe might be controversial for being excluded from this list is Cognex (NASDAQ:CGNX). However, while trying to do decide on whether to include them, I found their list of locations. They have three locations in California including two in Silicon Valley. That means that this ‘Boston’ company has more offices in Silicon Valley than in Boston. I’m not an advanced (or motivated) enough analyst to find out what the exact employee breakdown is, but combined with the fact that they make vision systems and supply components rather than robots, I elected to exclude them. I acknowledge that a similar case could be made about Adept (NASDAQ:ADEP) that just made a New Hampshire acquisition, but I have decided to include them and count them towards Silicon Valley. I do not believe that either of these decisions, substantively impact my finding that Silicon Valley is the leading cluster when it comes to public company workforce and value creation.

I’m hoping the people who are spreading the misinformation that Silicon Valley has to catch-up to Boston and Pittsburgh will publish corrections. I believe that this is important, particularly because I want to see Pittsburgh reclaim its early lead in robotics. So many robotic inventions can trace their heritage back to Pittsburgh, it is a real shame that Pittsburgh has not used this strength to create the kind of robotics business ecosystem that one would hope.

It is impossible for communities to take appropriate action if they do not understand where they stand. I hope that this new data will inspire the Pittsburgh community to come together and address the challenges of culture, customer access, and capital availability that have been inhibiting the growth of Pittsburgh’s robotic ecosystem before they lose too many more aspiring young entrepreneurs—such as me—to the siren song of California.

1,100

463

20%

2%

183

43

3%

0%

768

577

14%

2%

174

135

3%

1%

1,924

21,840

36%

88%

619

606

12%

2%

429

1,110

8%

4%

171

13

3%

0%

5,368

24,787

100%

100%

Filed under Clusters, Commentary, Economics, Finance, Public Companies Tagged with Boston, business, California, Clusters, drones, economic, Equity, financing, hizook, market capitalization, New England, Public Securities, robotics, Silicon Valley, Stock, VC, Venture Capital, workforce