2012/06/24

by Robert Morris

A cleaned-up version of this article became my first post on Hizook. http://www.hizook.com/blog/2012/06/25/east-coast-chauvinism-robotics-time-face-facts-silicon-valley-kicking-our-butt#comment-971

_______

I have lots of love for Pittsburgh in particular, but it really pisses me off when people on the East Coast repeat a bunch of falsehoods (See #8) about how Boston and Pittsburgh compare to Silicon Valley and the rest of the world. Many people in Pittsburgh and Boston—including people I call friends and mentors—smugly think that the MIT and CMU centered robotics clusters are leading the world in robotics. This is demonstrably false.

If leadership in robotics means forming companies, making money, or employing people, then Silicon Valley is crushing everyone—no matter what the Wall Street Journal editorial page says about their business climate. I’ve previously published an analysis of the Hizook 2011 VC Funding in Robotics data that shows that the Valley gets 49% of total VC robotics investment worldwide.

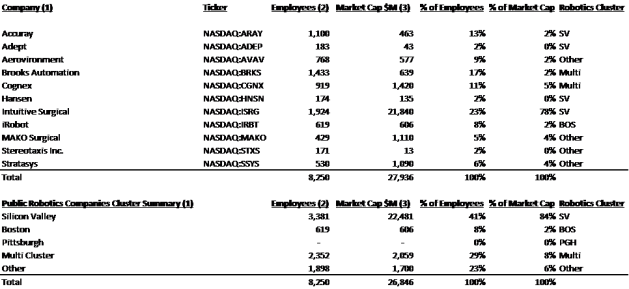

I’d now like to add an analysis of U.S. public companies (see bottom of the page). Basically, the ‘Pittsburgh and Boston are the center of the robotics world’ story is even more ridiculous if you look at where public robotics companies are located. Silicon Valley is crushing the other clusters in the U.S. at creating value in robotics and in building a robotics workforce in public companies. (A forthcoming analysis will show that this true worldwide and if you include robotics divisions of public companies not principally engaged in robotics such as Boeing and Textron.)

77% of the workforce at public robotics pure plays is in Silicon Valley companies. An astounding 93% of the market capitalization is headquartered in Silicon Valley and even if you exclude Intuitive Surgical (NASDAQ:ISRG) as an outlier, the Silicon Valley cluster still has twice as much market capitalization as Boston.

The public companies that I deemed to meet the criteria of being principally engaged in robotics, that they had to make and sell a robot, and not have substantial value creating revenues from businesses not related to robotics are listed in the table below.

The one company that I believe might be controversial for being excluded from this list is Cognex (NASDAQ:CGNX). However, while trying to do decide on whether to include them, I found their list of locations. They have three locations in California including two in Silicon Valley. That means that this ‘Boston’ company has more offices in Silicon Valley than in Boston. I’m not an advanced (or motivated) enough analyst to find out what the exact employee breakdown is, but combined with the fact that they make vision systems and supply components rather than robots, I elected to exclude them. I acknowledge that a similar case could be made about Adept (NASDAQ:ADEP) that just made a New Hampshire acquisition, but I have decided to include them and count them towards Silicon Valley. I do not believe that either of these decisions, substantively impact my finding that Silicon Valley is the leading cluster when it comes to public company workforce and value creation.

I’m hoping the people who are spreading the misinformation that Silicon Valley has to catch-up to Boston and Pittsburgh will publish corrections. I believe that this is important, particularly because I want to see Pittsburgh reclaim its early lead in robotics. So many robotic inventions can trace their heritage back to Pittsburgh, it is a real shame that Pittsburgh has not used this strength to create the kind of robotics business ecosystem that one would hope.

It is impossible for communities to take appropriate action if they do not understand where they stand. I hope that this new data will inspire the Pittsburgh community to come together and address the challenges of culture, customer access, and capital availability that have been inhibiting the growth of Pittsburgh’s robotic ecosystem before they lose too many more aspiring young entrepreneurs—such as me—to the siren song of California.

| Company (1) |

Ticker |

Employees (2) |

Market Cap $M (3) |

% of Employees |

% of Market Cap |

Robotics Cluster |

|

|

|

|

|

|

|

| Accuray |

NASDAQ:ARAY |

1,100

|

463

|

20%

|

2%

|

SV |

| Adept |

NASDAQ:ADEP |

183

|

43

|

3%

|

0%

|

SV |

| Aerovironment |

NASDAQ:AVAV |

768

|

577

|

14%

|

2%

|

SV |

| Hansen |

NASDAQ:HNSN |

174

|

135

|

3%

|

1%

|

SV |

| Intuitive Surgical |

NASDAQ:ISRG |

1,924

|

21,840

|

36%

|

88%

|

SV |

| iRobot |

NASDAQ:IRBT |

619

|

606

|

12%

|

2%

|

BOS |

| MAKO Surgical |

NASDAQ:MAKO |

429

|

1,110

|

8%

|

4%

|

Other |

| Stereotaxis Inc. |

NASDAQ:STXS |

171

|

13

|

3%

|

0%

|

Other |

| Total |

|

5,368

|

24,787

|

100%

|

100%

|

|

|

|

|

|

|

|

|

| (1) Companies are U.S. public companies that have been identified by Frank Tobe’s or my own research as principally engaged in robotics |

| (2) Employee Count as of Last 10-K Filing |

| (3) Market Capitalization as of 6/24/2012 |

Before we can even have a bubble in robotics…

2012/06/29 by Robert Morris Leave a comment

Our industry needs a better methodology for managing robotics development.

I just a had a great entrepreneurship conversation. My entrepreneur friend opened my eyes to the possibilities for robotics in an industry, platform space, and application that I had pretty much written off. The application was using robots to collect data–the simplest and earliest task for any class of robots. He had taken a fresh look at an industry he knew intimately and seen that there was an opportunity to do something extraordinary and make some money.

This friend is not a robotics expert, but he’s been awakened to the potential in the robotics field. His big concern and great hesitancy to jumping into this business is establishing a workable business model. He sees the potential in the opportunity with the vividness of an insider, but when it comes to the robotics he could use, he sees the immature, expensive junk of an outsider’s eye. He’s vividly aware of the danger he might not structure the business or implement the technology in such a way as to be the guy who becomes profitable and grows first. He saw that it would take a lot of money and time just to prove out the concept and that it might take much longer to figure out the right business model. Meanwhile, his fledgling robotics company would be burning cash at the combined rate of a software, hardware, and an operations company with a direct sales force–not a very pretty proposition.

I didn’t really have anything to say to him on that front other than hackneyed cliches about iterating, pivoting, and the value of moving early. It really occurs to me that my friend is already following what little we know about how to build a robotics company. Be a great whatever-you-are first (medical device, logistics solution, toy, etc.) then have it be a robot. Don’t market the thing as a robot; market it as a new technology solution to a real problem that is worth money to solve. Be willing it iterate (fail on first attempts). Go to market with the least capability that you can get paid any money at all for. All great principles, but it seems like we’re still missing the kind of prescriptions that have developed for software.

The Lean Start-up movement, combined with movements like Agile Development have brought much more rigor to how software development in early stage companies is managed. More traditional software and engineer models are still applicable to projects where the desired outcome is well known. In most of my conversations with engineers, it seems like robotics engineering has not reached a similar stage of maturity. It is difficult for robotics engineers to communicate to business leaders when they will know something that allows for opportunities in business decision making, let alone accurately forecast the true cost of a development job.

The most successful robotics companies do a great job managing development. However, when you talk to their founders or engineering leads, they are often at a loss to explain what they did differently from failed efforts. They might explain how they avoided some basic pitfalls–like outsourcing design work–but they often have a very difficult time offering an affirmative description of what they did, why it worked, and how they kept the engineering process and the business on track towards the correct goal. If robotics is ever going to be the semi-conductors of the 80’s, web of the 90’s, or social and mobile of today, our industry will need to develop a compelling description of how to stay on track towards successful technology and business outcomes.

Filed under Commentary, Start-ups, System Development Tagged with agile development, agile manifesto, budget, business, business model, development, device, financing, lean, medical, robot, robotics, start-up, supply chain, surgical, technology